等额本息还款计算器 等额本息还款法的计算公式

大家好,今天给各位分享等额本息还款计算器的一些知识,其中也会对等额本息还款法的计算公式进行解释,文章篇幅可能偏长,如果能碰巧解决你现在面临的问题,别忘了关注本站,现在就马上开始吧!

本文目录

等额本息还款法的计算公式

等额本息是指一种购房贷款的还款方式,是在还款期内,每月偿还同等数额的贷款(包括本金和利息)。每月还款额计算公式如下:[贷款本金×月利率×(1+月利率)^还款月数]/[(1+月利率)^还款月数-1]

等额本息还款计算器每月应还多少本金和利息

我可以帮你计算,不过一定要采纳我的回答哈,谢谢!

贷款39万元,按20年计算,利率是85折,应该是5.5675%。

贷款总额:390,000.00元还款总额:700,614.43元

利息总额:310,614.43元首期还款额:2,919.23元贷款期限:240

你每个月还款情况如下表,只能查到前120个月的情况哈。

还款期数当期还款额当期本金当期利息本金结余12,919.23790.482,128.75389,209.52 22,919.23794.792,124.44388,414.73 32,919.23799.132,120.10387,615.60 42,919.23803.492,115.74386,812.11 52,919.23807.882,111.35386,004.23 62,919.23812.292,106.94385,191.95 72,919.23816.722,102.51384,375.23 82,919.23821.182,098.05383,554.05 92,919.23825.662,093.57382,728.39 102,919.23830.172,089.06381,898.22 112,919.23834.72,084.53381,063.52 122,919.23839.262,079.97380,224.26 132,919.23843.842,075.39379,380.43 142,919.23848.442,070.78378,531.99 152,919.23853.072,066.15377,678.91 162,919.23857.732,061.50376,821.18 172,919.23862.412,056.82375,958.77 182,919.23867.122,052.11375,091.65 192,919.23871.852,047.38374,219.80 202,919.23876.612,042.62373,343.19 212,919.23881.42,037.83372,461.80 222,919.23886.212,033.02371,575.59 232,919.23891.042,028.18370,684.55 242,919.23895.912,023.32369,788.64 252,919.23900.82,018.43368,887.84 262,919.23905.712,013.51367,982.13 272,919.23910.662,008.57367,071.47 282,919.23915.632,003.60366,155.84 292,919.23920.631,998.60365,235.22 302,919.23925.651,993.58364,309.57 312,919.23930.71,988.52363,378.86 322,919.23935.781,983.44362,443.08 332,919.23940.891,978.34361,502.19 342,919.23946.031,973.20360,556.16 352,919.23951.191,968.04359,604.97 362,919.23956.381,962.84358,648.58 372,919.23961.61,957.62357,686.98 382,919.23966.851,952.37356,720.13 392,919.23972.131,947.10355,747.00 402,919.23977.441,941.79354,770.56 412,919.23982.771,936.46353,787.79 422,919.23988.141,931.09352,799.66 432,919.23993.531,925.70351,806.13 442,919.23998.951,920.28350,807.18 452,919.231,004.401,914.82349,802.77 462,919.231,009.891,909.34348,792.89 472,919.231,015.401,903.83347,777.49 482,919.231,020.941,898.29346,756.55 492,919.231,026.511,892.71345,730.03 502,919.231,032.121,887.11344,697.92 512,919.231,037.751,881.48343,660.16 522,919.231,043.421,875.81342,616.75 532,919.231,049.111,870.12341,567.64 542,919.231,054.841,864.39340,512.80 552,919.231,060.591,858.63339,452.21 562,919.231,066.381,852.84338,385.82 572,919.231,072.201,847.02337,313.62 582,919.231,078.061,841.17336,235.56 592,919.231,083.941,835.29335,151.62 602,919.231,089.861,829.37334,061.76 612,919.231,095.811,823.42332,965.96 622,919.231,101.791,817.44331,864.17 632,919.231,107.801,811.43330,756.37 642,919.231,113.851,805.38329,642.52 652,919.231,119.931,799.30328,522.59 662,919.231,126.041,793.19327,396.55 672,919.231,132.191,787.04326,264.36 682,919.231,138.371,780.86325,125.00 692,919.231,144.581,774.65323,981.42 702,919.231,150.831,768.40322,830.59 712,919.231,157.111,762.12321,673.48 722,919.231,163.431,755.80320,510.05 732,919.231,169.781,749.45319,340.28 742,919.231,176.161,743.07318,164.12 752,919.231,182.581,736.65316,981.53 762,919.231,189.041,730.19315,792.50 772,919.231,195.531,723.70314,596.97 782,919.231,202.051,717.18313,394.92 792,919.231,208.611,710.61312,186.31 802,919.231,215.211,704.02310,971.10 812,919.231,221.841,697.38309,749.26 822,919.231,228.511,690.71308,520.74 832,919.231,235.221,684.01307,285.53 842,919.231,241.961,677.27306,043.57 852,919.231,248.741,670.49304,794.83 862,919.231,255.561,663.67303,539.27 872,919.231,262.411,656.82302,276.86 882,919.231,269.301,649.93301,007.56 892,919.231,276.231,642.00299,731.34 902,919.231,283.191,636.03298,448.14 912,919.231,290.201,629.03297,157.95 922,919.231,297.241,621.99295,860.71 932,919.231,304.321,614.91294,556.39 942,919.231,311.441,607.79293,244.95 952,919.231,318.601,600.63291,926.35 962,919.231,325.801,593.43290,600.55 972,919.231,333.031,586.19289,267.52 982,919.231,340.311,578.92287,927.21 992,919.231,347.621,571.60286,579.59 1002,919.231,354.981,564.25285,224.61 1012,919.231,362.381,556.85283,862.23 1022,919.231,369.811,549.41282,492.42 1032,919.231,377.291,541.94281,115.13 1042,919.231,384.811,534.42279,730.32 1052,919.231,392.371,526.86278,337.96 1062,919.231,399.971,519.26276,937.99 1072,919.231,407.611,511.62275,530.39 1082,919.231,415.291,503.94274,115.10 1092,919.231,423.021,496.21272,692.08 1102,919.231,430.781,488.44271,261.30 1112,919.231,438.591,480.63269,822.71 1122,919.231,446.441,472.78268,376.26 1132,919.231,454.341,464.89266,921.92 1142,919.231,462.281,456.95265,459.64 1152,919.231,470.261,448.97263,989.39 1162,919.231,478.281,440.94262,511.10 1172,919.231,486.351,432.87261,024.75 1182,919.231,494.471,424.76259,530.28 1192,919.231,502.621,416.60258,027.66 1202,919.231,510.831,408.40256,516.83

等额本息计算公式

房贷分两种支付方式:等额本息和等额本金,具体公式如下:等额本息:〔贷款本金×月利率×(1+月利率)^还款月数〕÷〔(1+月利率)^还款月数-1〕等额本金:每月还款金额=(贷款本金/还款月数)+(本金—已归还本金累计额)×每月利率其中^符号表示乘方。2个月就是2次方。

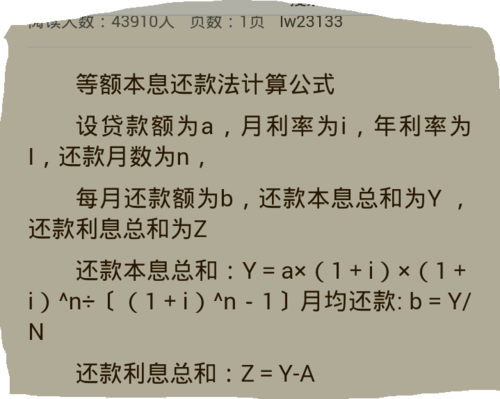

等额本息还款计算公式

等额本息计算公式:〔贷款本金×月利率×(1+月利率)^还款月数〕÷〔(1+月利率)^还款月数-1〕

等额本金计算公式:每月还款金额=(贷款本金÷还款月数)+(本金—已归还本金累计额)×每月利率

等额本息,是指一种贷款的还款方式。等额本息是在还款期内,每月偿还同等数额的贷款(包括本金和利息)。

扩展资料

等额本息还款法,即借款人每月按相等的金额偿还贷款本息,其中每月贷款利息按月初剩余贷款本金计算并逐月付清。这种还款方式,便于借款人合理安排每月的生活和进行理财(如以租养房等),对于精通投资、擅长于“以钱生钱”的人来说,无疑是较好的选择。

举例说明

假设以10000元为本金、在银行贷款10年、基准利率是6.65%,比较下两种贷款方式的差异:

等额本息还款法

月利率=年利率÷12=0.0665÷12=0.005541667

月还款本息=〔10000×0.005541667×(1+0.005541667)^120〕÷〔(1+0.005541667)^120-1〕=114.3127元

合计还款13717.52元

合计利息3717.52万元

等额本金还款法:

每月还款金额=(贷款本金÷还款月数)+(本金—已归还本金累计额)×每月利率

=(10000÷120)+(10000—已归还本金累计额)×0.005541667

首月还款138.75元每月递减0.462元

合计还款13352.71元

利息3352.71元

参考资料:百度百科——等额本息

贷款月供计算公式

等额本金还款计算公式:

1.每月月供额=(贷款本金÷还款月数)+(贷款本金-已归还本金累计额)×月利率

2.每月应还本金=贷款本金÷还款月数

3.每月应还利息=剩余本金×月利率=(贷款本金-已归还本金累计额)×月利率

4.每月月供递减额=每月应还本金×月利率=贷款本金÷还款月数×月利率

5.总利息=〔(总贷款额÷还款月数+总贷款额×月利率)+总贷款额÷还款月数×(1+月利率)〕÷2×还款月数-总贷款额

好了,关于等额本息还款计算器和等额本息还款法的计算公式的问题到这里结束啦,希望可以解决您的问题哈!

与本文知识相关的文章: